The Best Company Car Insurance in UK

The Best Company Car Insurance in UK: Company vehicle insurance works differently and offers more coverage than normal auto insurance policies. Determine when you will require one.

One of the most prevalent misunderstandings regarding auto insurance is that regular personal vehicle policies cover you if you drive your car for work. The truth is that your regular car insurance covers you just if you use your vehicle for commuting and social outings.

If you use your automobile for business, you will require a separate sort of policy. This type of coverage, known as company vehicle insurance, operates differently and provides a higher degree of protection than standard car plans.

If you’re one of the millions of British drivers who rely on their automobiles for work, this advice will come in handy. We’ll go over how company car insurance works, how it differs from other types of auto insurance, and what factors influence cost. Insurance agents can also share this information with their clients to help them locate the best vehicle insurance for their needs. We encourage insurance experts who read our site to forward this to any of their clients who believe they do not require this coverage.

What is company car insurance and how does it work?

Company car insurance, often known as business car insurance, is a form of policy that covers vehicles used for work-related reasons, except commuting, which is covered by normal motor insurance. This means that if your “work-related” use of your vehicle is restricted to your daily journey to the same office, you do not require a corporate car policy.

However, if driving is a regular component of your employment, you must have company vehicle insurance. When selecting the best policy for your needs, you have three “classes of use” to choose from, each with a different degree of coverage. They are as follows:

- Class 1: The most affordable type of coverage, this provides coverage if you drive to different work sites such as regional offices or to meet clients.

- Class 2: This policy provides the same coverage as Class 1 but allows you to add a named driver, typically a coworker.

- Class 3: Also known as “commercial travel,” this category includes work-related driving to an infinite number of places. This type of insurance is ideal for personnel that are constantly on the road, such as truck drivers and sales reps. Because it is meant for high-mileage drivers, it is also the most expensive type of insurance.

If your firm owns a business-use car, it is its responsibility to obtain coverage and pay the premiums. Businesses should bear the excess in the case of a dispute. Some companies, on the other hand, incentivize cautious driving by putting the burden of paying the excess to the drivers.

Owners of privately owned cars used for work and receiving a fixed mileage allowance, commonly known as grey fleet vehicles, are responsible for obtaining their own insurance. Companies, on the other hand, should ensure that these vehicles have at least the most basic level of coverage allowed by law.

Read More: European health insurance card – Who is eligible and how to Get

What does company car insurance cover?

Every car in the United Kingdom, including those used for business, is required to obtain third-party insurance. This is the bare minimum of coverage required to drive legally. According to the Association of British Insurers (ABI), drivers can obtain three forms of protection. They are as follows:

- Third-party coverage: The most fundamental form of protection, covers any injuries or damage you cause to other people, property, or cars.

- Coverage for third-party fire and theft (TPFT): TPFT provides the same protection as third-party coverage, but it also pays out if your automobile is stolen or burns down. Some insurers also require automobiles to have a security system installed in order to receive theft coverage.

- Comprehensive coverage: In addition to third-party, fire, and theft coverage, comprehensive policies pay for the expense of repairing your car following an accident, even if you were at fault. This also provides the most comprehensive coverage.

Aside from these conventional coverages, company car insurance offers additional protection designed specifically for business-use automobiles. This includes protection for:

- Travel between work locations or offices.

- Driving around coworkers who are on business.

- Clients or consumers are being visited or picked up.

- Attending conferences, trade shows, and training.

- Driving to do administrative activities for business, such as going to the bank

- Other personnel are operating your vehicle.

What isn’t covered by company car insurance?

Vehicles used by enterprises for commercial purposes are not covered by company car insurance. Some of these cars are listed in the table below.

Commercial motor insurance is legally necessary for these types of cars, which we shall go over in detail in the following section.

What is the difference between company car insurance and commercial motor insurance?

All vehicles in the UK are required to have insurance before they may be driven on British roads. Company cars and commercial vehicles are examples of this. However, various policies are required for these types of vehicles.

If you use your vehicle for job-related purposes, such as traveling between work locations or visiting clients, you must have company car insurance. Meanwhile, commercial automobile insurance is intended for vehicles used by enterprises for commercial purposes, such as those specified in the preceding section.

Commercial auto insurance coverage is classified into two types:

- Fleet insurance: A single policy covers many cars owned by a firm. Rental automobiles, trucks, minibusses, vans, or a combination of several types of commercial vehicles can be included.

- Non-fleet insurance: This type of policy covers one to five vehicles under a single policy.

How much does company car insurance cost?

According to the price comparison and insurer websites examined by Insurance Business, the typical cost of a fully comprehensive company car insurance coverage begins at around £400 and can surpass £600. And, like with ordinary auto insurance, the rate for your company car may be greater or lower depending on a variety of criteria, such as:

- Your personal information, such as your age, gender, place of residence, and occupation

- Your driving record.

- Drivers have been named.

- When and where you go for business.

- The industry you work in and the purpose of the car for work.

- The make, model, and model year of the vehicle you’re driving. insurance group.

- The extent of coverage.

Company car insurance is often more expensive than normal auto insurance because work-related driving necessitates covering more miles, sometimes at peak periods and on unfamiliar roads. Because of these characteristics, car insurers regard drivers of business-use vehicles as more risky to insure.

If you’re a business owner looking for a work car that won’t break the bank to cover, have a look at our list of the cheapest cars to insure in the UK.

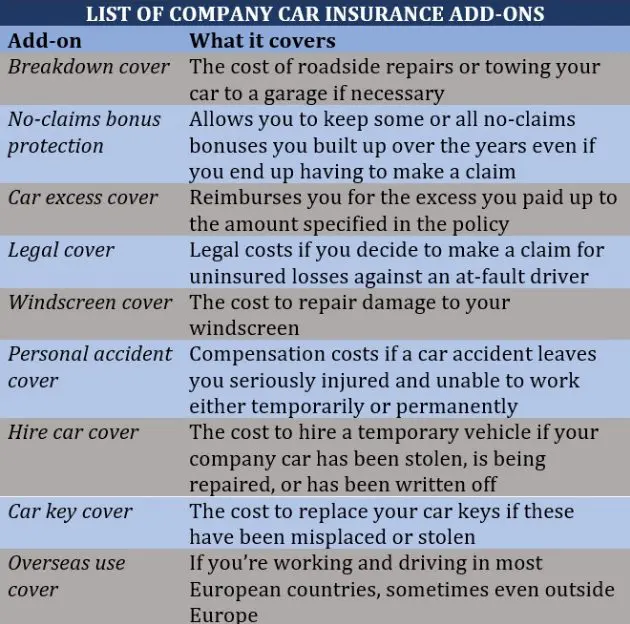

What add-ons are available for company car insurance?

Because each driver’s demands differ, even highly comprehensive auto insurance policies may not provide complete coverage. As a result, some insurers provide drivers with a variety of add-ons to supplement the coverage provided by their company vehicle insurance policy. Some of these optional options are listed in the table below.

How can you save on company car insurance?

You won’t have to worry about paying premiums if your firm owns your work vehicle. However, if you operate a business or use your personal car for work-related purposes, you will most likely need to acquire company car insurance and pay for coverage yourself. And, given the high cost of insurance premiums for business-use vehicles, it pays to have a strategy in place to reduce the amount you pay.

Here are some basic techniques for lowering your company’s vehicle insurance prices.

- Shop around and compare quotes to verify that you are obtaining the best rates for the coverage you require.

- When purchasing an automobile, consider the insurance costs: More costly cars are frequently more expensive to fix because their parts are difficult to find and replace, raising your insurance prices.

- Before purchasing, please read the following policy: Read your policy document thoroughly to ensure that you understand what you will be covered for and how much a policy will cost you. This keeps you from overpaying for insurance.

- Maintaining a clean driving record: One of the most efficient strategies to keep your corporate car insurance prices low is to keep your driving record immaculate.

- Annually review your policy: When it’s time to renew your policy, check to see if you’re still getting the best value for your money.

- Amass your no-claims bonus: You can do this by having consecutive claim-free years, so it pays to be strategic about what you claim.

- Set up anti-theft devices: Insurers appreciate that you’re improving the security of your work vehicle, and many will reward you with savings.

- Choose annual payments: Paying your premiums annually rather than monthly can save you a lot of money on your insurance.

- Reduce your mileage by using your work car as little as possible. Driving less reduces your chances of getting into an accident.

- Consider a greater excess: A higher excess implies lower rates, but be sure the amount is one you can afford.

Where can you find the best company car insurance providers in the UK?

If you’re seeking top-tier insurance firms in the UK that offer the greatest company car insurance policies, go no further than our greatest in Insurance Special Reports page. The insurers featured in our special reports have been vetted and recommended by their peers, and they have been recognized as reputable and dependable market leaders by our team of industry experts.

We have announced our five-star awards for the Best Commercial Car Insurance carriers in the United Kingdom. To achieve the coveted slots on our list, the insurance providers are graded based on numerous criteria, including claims management, response time, and underwriting ability. Aside from business motor insurance, these insurers provide a variety of car coverages, such as personal and company car insurance, to meet the diverse demands of British drivers. By working with these organizations, you can be assured of receiving first-rate security and customer service.

Are you looking for a company vehicle insurance policy that meets your requirements? Did you find our guide to be useful? Please share your thoughts in the comments box below.

People Also Ask

-

What type of car insurance is best UK?

In the case of an accident, fully comprehensive insurance provides the maximum level of protection. It may cost a little extra, but it might save you a lot of money if the worst happens. Comprehensive insurance will compensate for unintentional damage to your own vehicle, even if it was your fault.

-

Who is the biggest car insurer in the UK?

Admiral Group is the leading car insurance company in the United Kingdom, accounting for 14% of the total market share. The auto insurance specialist writes plans under numerous brands, including Admiral and Bell.